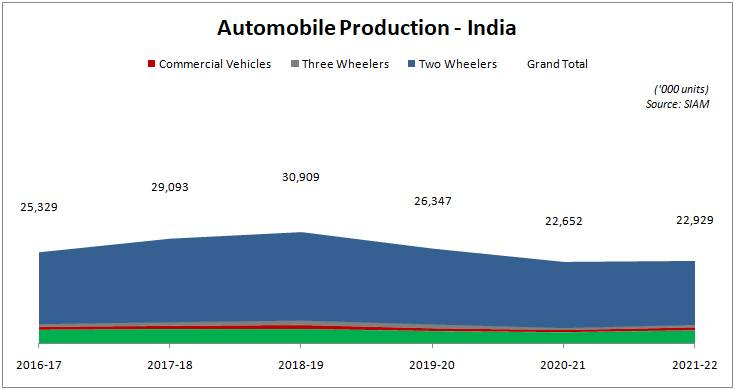

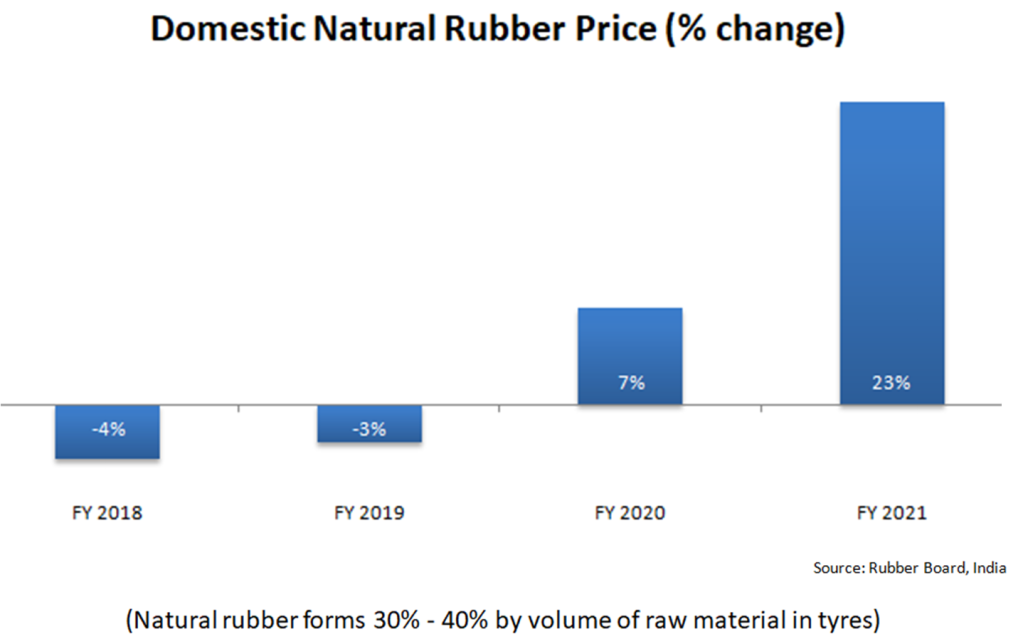

The Indian Tyre manufacturers have been witnessing significant margin contraction on the back of elevated commodity (raw material) prices over the past couple of years. This has come at a time when the automobile production in India are near 5 year low.

Although, the current challenges are substantial and will likely persist for the next one or two quarters, the Indian tyre industry, third largest in the world, is potentially on the cusp of a turnaround.

The global commodity prices are likely to be cooling off from their decade high levels as the Fed has had to bite the bullet and increase the interest rates. The low interest regime is a thing of the past now with more interest hikes forthcoming this year. This should taper off the commodity prices further which will provide a sigh of relief to the domestic tyre manufacturers as they have been grappling with high costs of raw materials such as carbon black, silica, rubber, steel, polyester, among others.

The Indian government has been actively encouraging domestic manufacturing units through key policy interventions. It introduced anti-dumping duty on tyres inbound from China in September 2017. The anti-dumping duty was further expanded to radial tyres of more than 16 inches in June 2019. The government has further imposed counter vailing duty. Currently, the customs duty on tyres from China is in the range 9.12% – 17.57% of CIF (Cost, Insurance, Freights).

The domestic players have fared well on the back of these protectionist measures taken by the government and have further appealed for extending them beyond September 2022, which is when the anti-dumping duties on Chinese tyre imports will get lifted. The Director General of Trade Remedies (DGTR) is currently reviewing the petition filed by Automotive Tyre Manufacturers Association (ATMA) for extending the period of anti-dumping duties on Chinese tyre imports for a period of 5 years. The government decision in this space remains a key monitorable for the industry and will have a material impact on the domestic tyre manufacturers.

In addition, the government has already introduced new norms for keeping in check several tyre parameters such as rolling resistance, rolling sound emissions, wet grip, among others. This will lead to “star rating” or labeling of tyres produced in India wherein the quality and performance of tyres may be gauged through above parameters. The mandatory norms shall be applicable to new models set to go into production from October 2022.

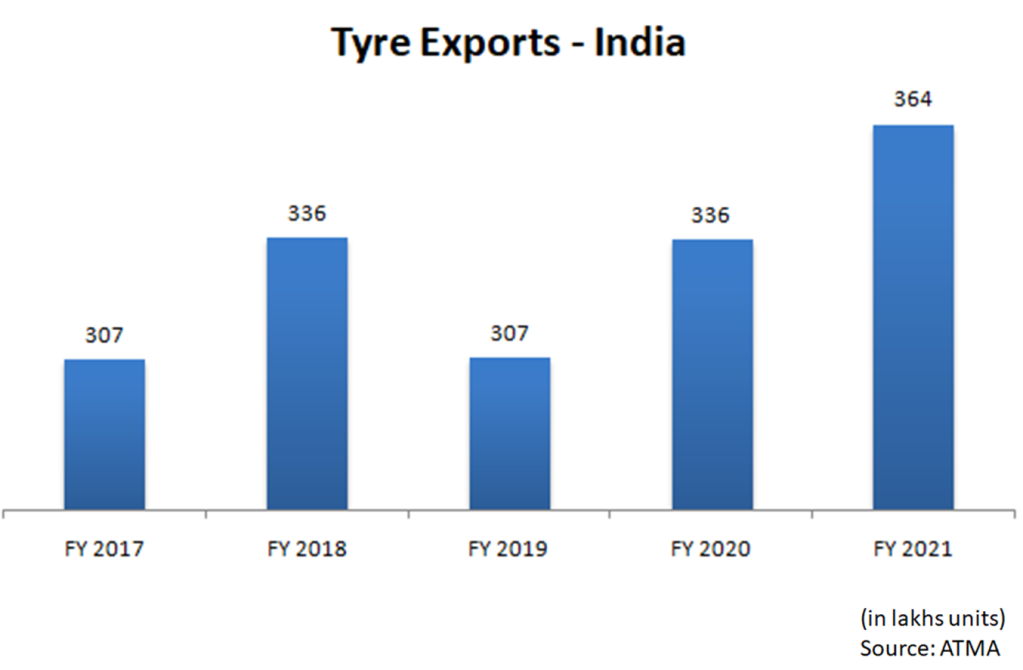

The commencement of norms will pave the way for further formalization across the industry and may bring the domestic production at par with global standards. This will only make exports more resilient which has been witnessing consistent growth over the past several years. In fact, tyres exports are at record high levels in FY 2022.

New product specification / mix for EVs

Additional CAPEX by incumbents (capacity addition)

Further, the domestic and foreign OEMs are sitting on huge backlogs of pending orders for passenger vehicles due to the supply constraints caused due to global semiconductor shortage. Although, the chip shortage is expected to persist throughout the second half of 2022, the supply is pegged to improve towards the year end.

Share this post